FOCUS ON NOVA REAL ESTATE®

Springfield Buying

Buying a Home in Springfield, Virginia

Springfield, Virginia, is a thriving suburban community in Fairfax County, situated about 15 miles southwest of Washington, D.C. As of 2024, it is home to approximately 32,000 residents. With its prime location, strong community atmosphere, and abundance of amenities, Springfield appeals to families, professionals, and retirees seeking a balanced suburban lifestyle with easy access to the D.C. metropolitan area.

Amenities and Lifestyle

Springfield boasts a wealth of recreational, shopping, and entertainment options. Springfield Town Center serves as a major retail and dining destination, featuring a variety of national chains and local businesses. For outdoor enthusiasts, Lake Accotink Park offers scenic hiking and biking trails, kayaking, and picnic areas. The community is also home to gyms, golf courses, and other family-friendly attractions. Springfield’s accessibility to major highways—including I-95, I-395, and I-495 (the Capital Beltway)—makes commuting to Washington, D.C., Arlington, and other Northern Virginia destinations convenient.

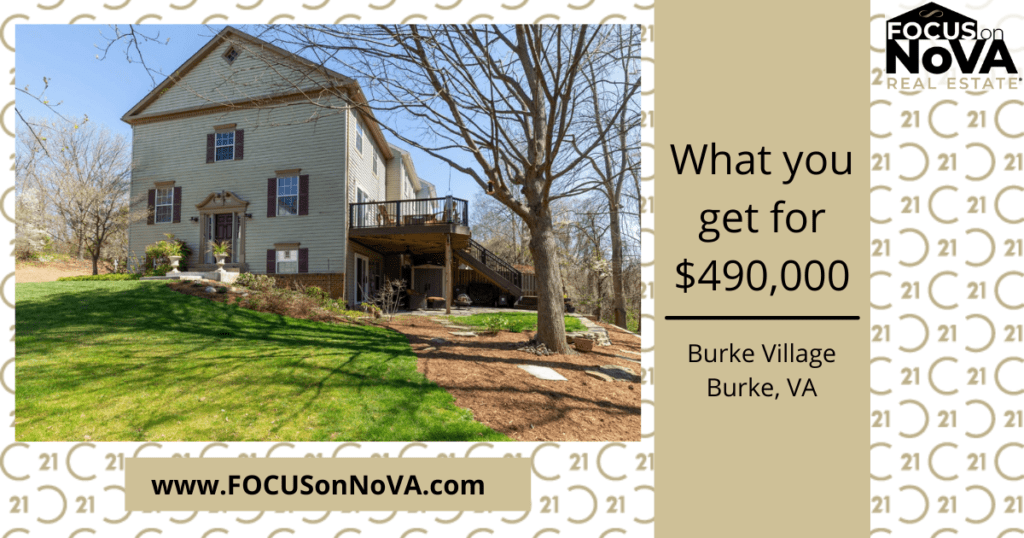

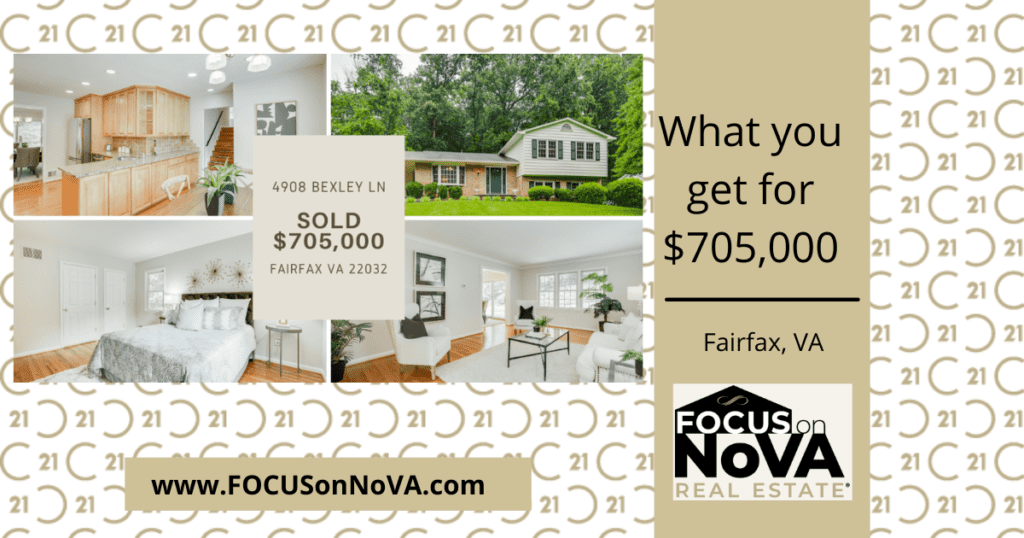

Housing Market

In 2024, the average home price in Springfield is approximately $625,000. The housing market is diverse, with a range of options including single-family homes, townhouses, and condominiums. Springfield is known for offering relatively more affordable housing compared to some nearby communities while still providing excellent amenities and convenience.

Education

Springfield is served by the highly regarded Fairfax County Public Schools system. Top-rated schools in the area include West Springfield High School, Irving Middle School, and Keene Mill Elementary, all known for their strong academic programs and community involvement.

Household Income

With a median household income of around $120,000, Springfield is a stable, middle-to-upper-middle-class community. The area offers employment opportunities in key industries such as government, defense, technology, and healthcare.

Springfield combines suburban comfort with urban convenience, making it an attractive choice for those seeking a well-rounded lifestyle in Northern Virginia.

Tips for Buying a Home in Springfield, VA

- Understand the Market

- Springfield’s real estate market is competitive due to its proximity to Washington, D.C.

- Be prepared for multiple-offer situations, especially for well-priced homes.

- Set a Realistic Budget

- The average home price in Springfield is around $625,000 in 2024.

- Get pre-approved for a mortgage to strengthen your offer.

- Work with a Local Real Estate Agent

- An agent familiar with Springfield can help you find the best properties quickly.

- They can also provide insights on market trends and neighborhood dynamics.

- Explore Different Neighborhoods

- Consider areas like West Springfield, Newington, and North Springfield.

- Prioritize proximity to amenities, schools, and commute routes.

- Evaluate the Commute

- Springfield offers excellent access to I-95, I-395, I-495, and the Metro’s Blue Line.

- Test drive your commute at different times to assess traffic patterns.

- Research Schools and Amenities

- Springfield is part of the highly-rated Fairfax County Public Schools system.

- Nearby amenities include Springfield Town Center, Lake Accotink Park, and dining options.

- Inspect the Home Thoroughly

- Older homes may require updates or repairs, so a professional inspection is crucial.

- Look for potential maintenance issues, especially in older properties.

- Consider Future Property Value

- Springfield’s market is stable, making it a strong investment.

- Research upcoming developments or infrastructure projects that may impact home values.

- Be Prepared to Act Quickly

- Desirable homes sell fast, so be ready to submit an offer promptly.

- Work with your agent to craft a competitive but reasonable offer.

- Plan for Closing Costs and Additional Expenses

- Factor in property taxes, homeowners insurance, and potential HOA fees.

- Budget for any renovations or upgrades after moving in.