FOCUS ON NOVA REAL ESTATE®

Herndon Buying

Buying a Home in Herndon, Virginia

Herndon, Virginia, is a growing suburban community located in Fairfax County, approximately 23 miles west of Washington, D.C. As of 2024, the population of Herndon is around 25,000 residents. The town offers a blend of small-town charm and modern amenities, making it a popular choice for families, young professionals, and commuters. Herndon’s proximity to major highways, such as the Dulles Toll Road, and the future Silver Line Metro station enhances its appeal for those working in D.C. or nearby business hubs like Reston and Tysons Corner.

Amenities and Lifestyle

Herndon is known for its vibrant community and convenient access to shopping, dining, and recreational activities. The town features several parks, including the popular Frying Pan Farm Park and the Herndon Centennial Golf Course. Residents enjoy a variety of dining options, from casual eateries to fine dining, and the nearby Reston Town Center offers additional retail and entertainment options. Herndon’s historic downtown area provides a mix of local shops, art galleries, and events that celebrate its history and culture.

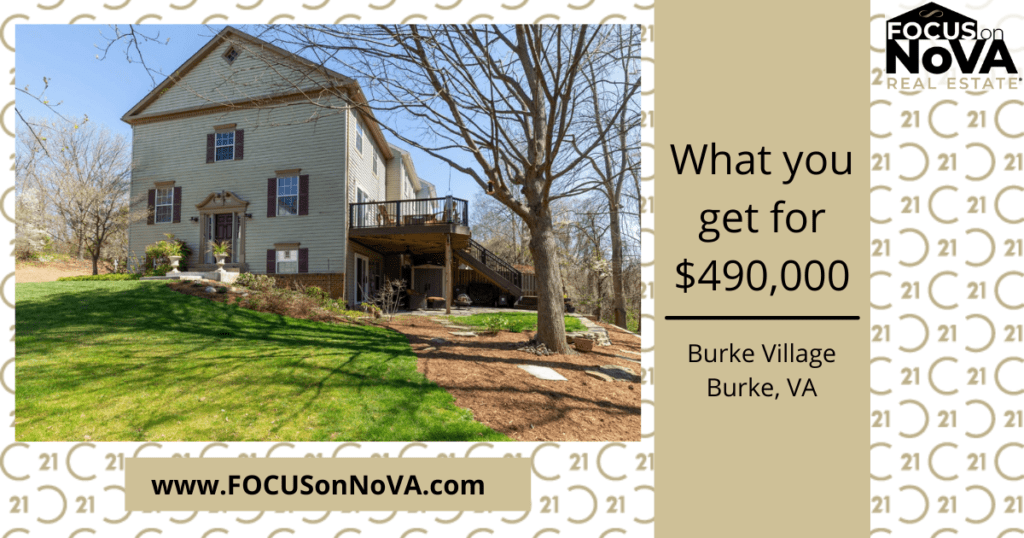

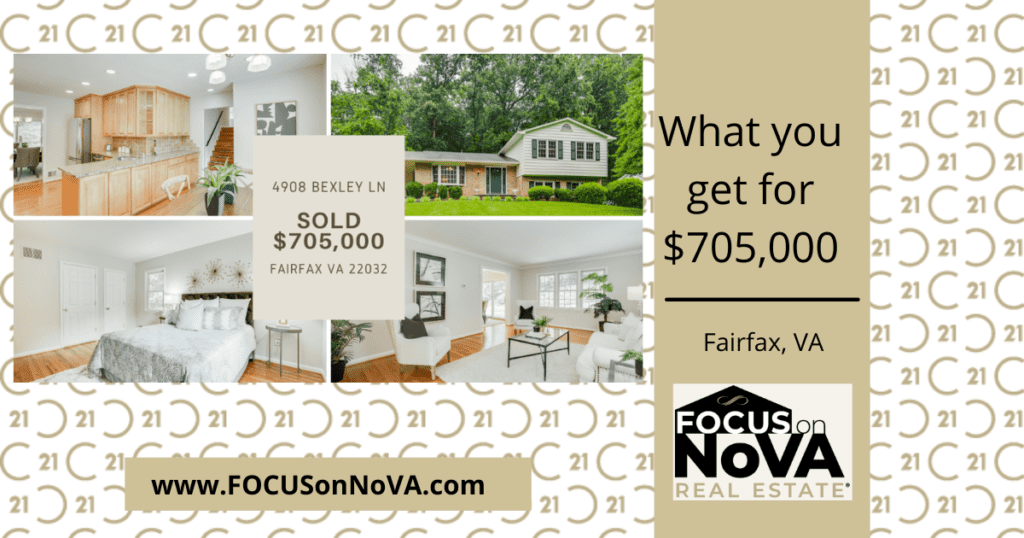

Housing Market

In 2024, the average sales price of a home in Herndon is approximately $560,000. The real estate market is competitive, with homes typically selling within a few weeks. Herndon offers a range of housing options, from single-family homes to townhomes and condos, catering to a variety of buyers.

Education

Herndon is served by the Fairfax County Public Schools system, one of the top school districts in the nation. The area is home to several highly rated schools, making it an attractive location for families seeking quality education.

Household Income

Herndon has a median household income of around $110,000, reflecting its thriving and diverse community. The town’s economic prosperity and prime location continue to make it an appealing place to live and work.

Tips on Buying a House in Herndon, VA

- Understand the Local Market – Research current market trends in Herndon, including average home prices and inventory levels. The market can be competitive, so understanding how long homes stay on the market will give you an edge.

- Set a Realistic Budget – Determine your budget based on your income, down payment, and financing options. Be sure to consider additional costs like property taxes, HOA fees, and maintenance.

- Get Pre-Approved for a Mortgage – Work with a lender to get pre-approved for a mortgage. This will help you understand how much you can afford and show sellers you’re a serious buyer, making your offers more attractive.

- Choose the Right Neighborhood – Explore different neighborhoods in Herndon to find the one that best fits your lifestyle. Consider proximity to schools, parks, restaurants, and major commuter routes like the Dulles Toll Road or future Silver Line Metro.

- Research Schools and Amenities – If you have children or are planning to in the future, research the local schools. Herndon is served by the Fairfax County Public Schools system, known for its quality education. Look into nearby parks, shopping centers, and dining options.

- Consider Future Growth and Development – Herndon is experiencing growth, particularly with the upcoming Silver Line Metro expansion. Consider how future development might affect property values and your lifestyle.

- Hire a Local Real Estate Agent – Work with a local real estate agent who understands the Herndon market and can help you navigate listings, negotiate offers, and avoid potential pitfalls.

- Attend Open Houses – Attend open houses to get a feel for different homes and neighborhoods. You can often spot issues early on and gauge if a home meets your needs.

- Look for Long-Term Value – When viewing homes, consider their long-term investment potential. Choose a property that will hold its value or appreciate over time, especially in up-and-coming areas of Herndon.

- Be Ready to Act Quickly – Homes in Herndon can move fast, so if you find a property you love, be prepared to make an offer quickly. Work with your agent to get an offer submitted as soon as possible.

- Get a Home Inspection – Always get a professional home inspection before closing to uncover potential issues with the property. This step helps ensure there are no hidden problems that could cost you later.

- Negotiate Wisely – Your real estate agent can assist with negotiations to ensure you get a fair deal. Whether it’s asking for repairs or negotiating the price, make sure you’re getting the best value for your money.