Dr. Lisa Sturtevant, Chief Economist for Bright MLS recently provided an update on the DMV real estate market and she had some interesting insights about the market and outlook for the fall.

Where We Are

The market is slow. In general homes are taking longer to sell. Buyers have more time to choose and make decisions versus the frenzied market we normally see in spring. Buyers are asking for home inspections and keeping financing and appraisal contingencies. While this is a great opportunity for buyers to purchase a home – It is still not a buyers market.

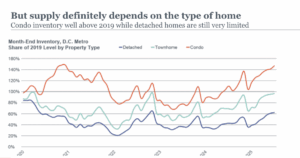

Inventory is still below pre-pandemic inventory. Further, we have to look at more than just inventory – supply depends on the type of home. Overall, inventory numbers are up but that is really because of condominiums. Condominium inventory is well above what it was in 2019 but detached single family homes are still very limited and well below pre-pandemic numbers.

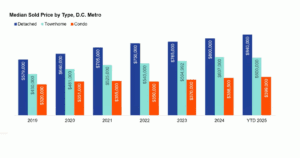

While median home prices are still rising it is not because prices across the board are rising. It is because the market has shifted to higher end sales versus first time and moderate homebuyers. This means a higher share of sales are concentrated in luxury homes. This is likely because buyers in that market feel a little more economically secure than first time homebuyers.

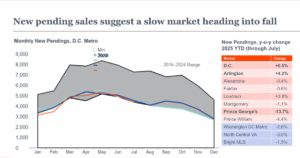

Pending sales are lower because we have seen a pull back in buyer demand. This can be based on several factors including:

- economy in the region

- mortgage rates

- federal worker layoffs

- buyers feeling uncertain

Outlook

Moving into the fall, Sturtevant predicts that it will not be a buyers market and not a sellers market – but a stuck market. What is causing this?

Affordability is a big factor as fewer prospective buyers can get into the market due to increased prices and increased mortgage rates. The median price for a single family home in DMV metro area has jumped from $579,000 in 2019 to $840,000 in 2025.

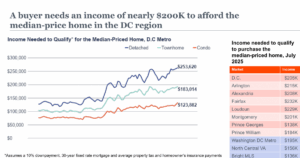

Correspondingly, the income required for buyers to qualify for a median priced home has jumped significantly. In 2019, buyers needed an income of $100,000 to purchase a townhouse. To qualify in 2025, that same buyer needs an income of $183,014. To purchase a single family home in 2019, buyers needed an income of $125,000. To qualify in 2025, that same buyer needs an income of $253,620. This is preventing many buyers from entering the townhome and single family market.

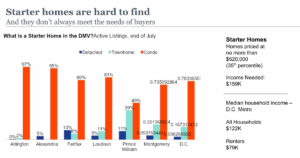

Further emphasizing the lack of affordability, Sturtevant points out that starter homes (homes priced under $529,000 in the DMV footprint) are hard to find and don’t always meet the needs of the buyer. A majority of starter homes in Northern Virginia fall into the condominium category. Meaning that the majority of buyers entering the market are buying a condominium because they are priced out of detached and townhome properties. In Fairfax, 80% of starter homes are condominiums. In Alexandria it’s 95% and in Arlington it’s 97%.

There has been a slight uptick in contract fall-through rates where a property goes under contract and then the buyer voids the contract and property goes back on the market. When this happens it pushes pending sales lower.

There has also been an uptick in de-listing rates – where a seller who has a property on the market decides to take the property off the market. The primary reason for delisting is because the seller did not get the price they wanted. This also affects a forward moving market.

Sturtevant predicts that mortgage rates may come down slightly but it won’t have an impact on the market.